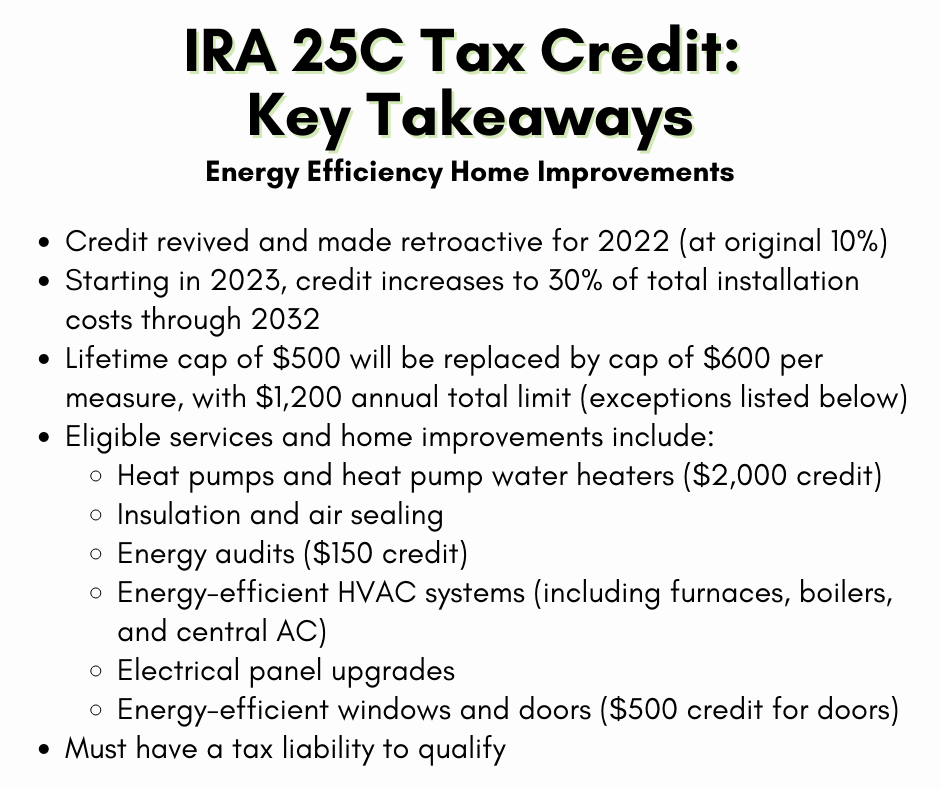

With renewed tax credits and rebates under the "Inflation Reduction Act", you can receive money back just for installing a new energy-efficient system! The 25C Tax Credit, which is an extension of an existing tax credit, covers eligible services and home improvements such as heat pumps, heat pump water heaters, insulation and air sealing, energy audits, and more.

Details on the 25C Tax Credit

So, for just how long can you claim this tax credit? The tax credit becomes available in 2023 and can be claimed through 2032. Under the new extension, the credit is increased to 30 percent of total installation costs. Remember -- to receive a tax credit, you must have a tax liability.

In order to claim the credit within a given tax year, you will need to make sure your projects are completed by the end of that year. For example, if you want to claim the credit on the taxes you file in 2024, the project needs to be completed by December 31, 2023. That's why it's important to get started on any projects as soon as possible. If you live in the Delaware Valley and would like to start with a free estimate on a new HVAC system, such as a heat pump, contact us here.

If you live in the Delaware Valley/Greater Philadelphia area and would like to find comfort within your home, visit our website or give us a call at 215 - 245 - 3200 to learn more.