The Inflation Reduction Act (IRA) signed by President Biden in August 2022 aims to build a new economy that helps working families. These actions will push to switch households and companies over to clean energy, save American households up to thousands of dollars a year, and tackle the climate crisis in the United States. Switching and installing certified energy-efficient systems can put money back in Americans' pockets through tax credits and rebates. These tax credits cover a wide range of home energy-efficiency improvements, including equipment like heat pumps, air conditioners, heat pump water heaters, doors, windows, insulation, and more.

This act will be in place until 2032, giving Americans ten years to make all the improvements they want. Households can add efficient upgrades to their home every year for the next ten years to claim their maximum available rebate and tax credit based on their income and region. These tax credits and rebates can equate to more than one thousand dollars per year.

Let's Focus on Heat Pump Tax Credits and Rebates

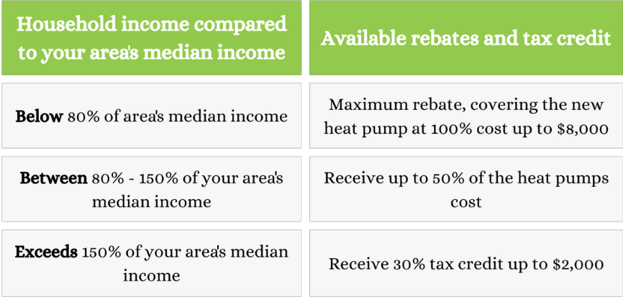

Heat pumps have a different exception than the rest of the home improvement rebates and tax credits. Households can deduct 30 percent of the costs of buying AND installing a heat pump water heater or heat pump for their space heating or cooling up to $2,000. This includes all-electric system upgrades that are needed to make the home heat pump ready.

Beginning this year, low and moderate-income households are offered household rebates for heat pumps at the point of sale, cutting costs of purchase and installation up to $8,000. If home electrical upgrades are needed to integrate new heat pumps, rebates of up to $4,000 are available. These are through state programs.

*This is understood as a tax CREDIT, not a tax REDUCTION*

The money households can receive is based on income relative to the median income in their region.

This easy-to-use AMI (Area Median Median) tool can help you get an idea of your income based on your area.

Why a heat pump?

An all-electric heat pump...

-

Helps reduce your home's carbon footprint

-

Does not produce combustion byproducts

-

Does not utilize fossil fuels to maintain indoor comfort

-

IS ELIGIBLE FOR REBATES AND TAX CREDITS!

Heat pump efficiency

The Inflation Reduction Act comes with new testing procedures HVAC systems must pass to be considered energy efficient. SEER, EER, and HSPF ratings have been replaced with updated ratings named SEER2, EER2, and HSPF2.

SEER stands for Seasonal Energy Efficiency Rating. EER stands for Energy Efficiency Rating. These two are nearly identical. The only difference is that EER is calculated on constant outdoor temperatures of 95°F, while SEER is calculated on temperatures ranging from 65°F to 104°F. HSPF stands for Heating Seasonal Performance Factor. If you are unfamiliar with these terms, check out our posts below to get some quick information:

How do I know if my heat pump is eligible for tax credits and rebates?

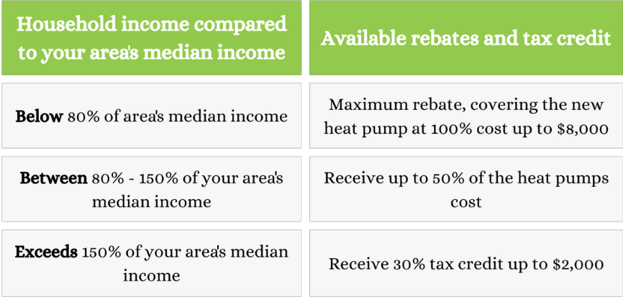

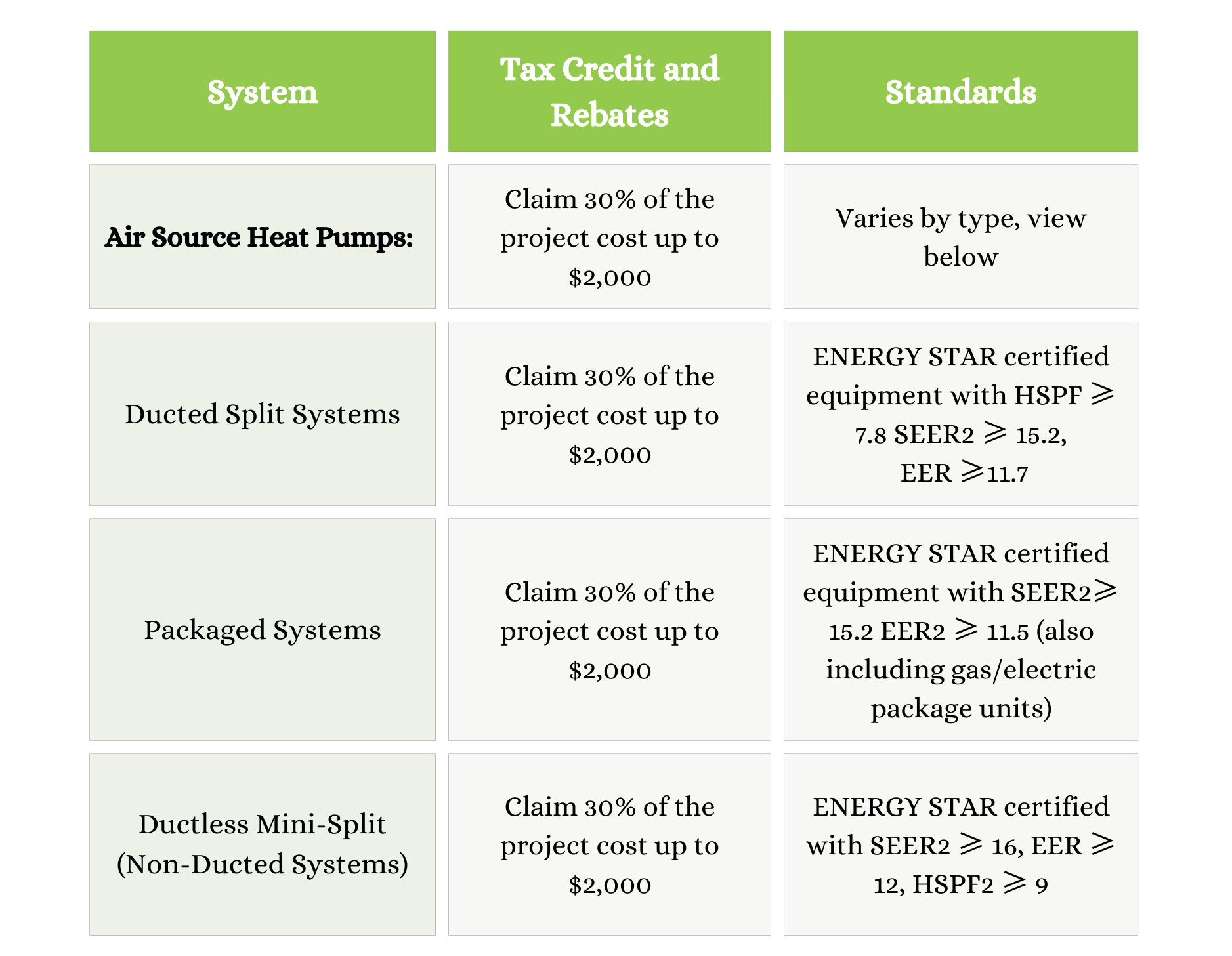

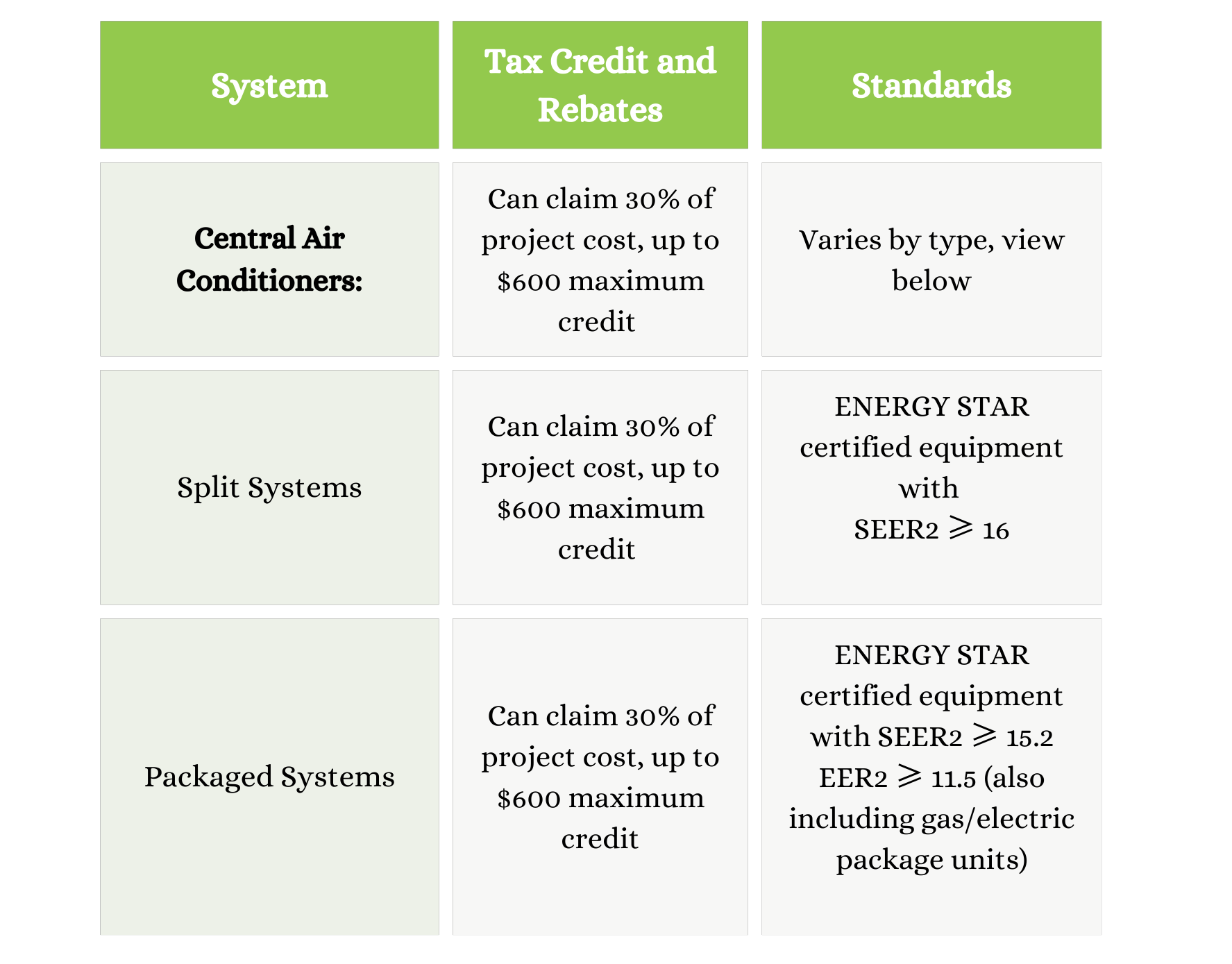

type of system

Back to upgrading systems, here is a breakdown that details air conditioner and heat pump requirements to be eligible for tax credits and rebates. It's important to consult your accountant or another tax professional to ensure that you meet all requirements necessary to receive tax credits for your home improvements.

The following system MUST MEET the following efficiency standards:

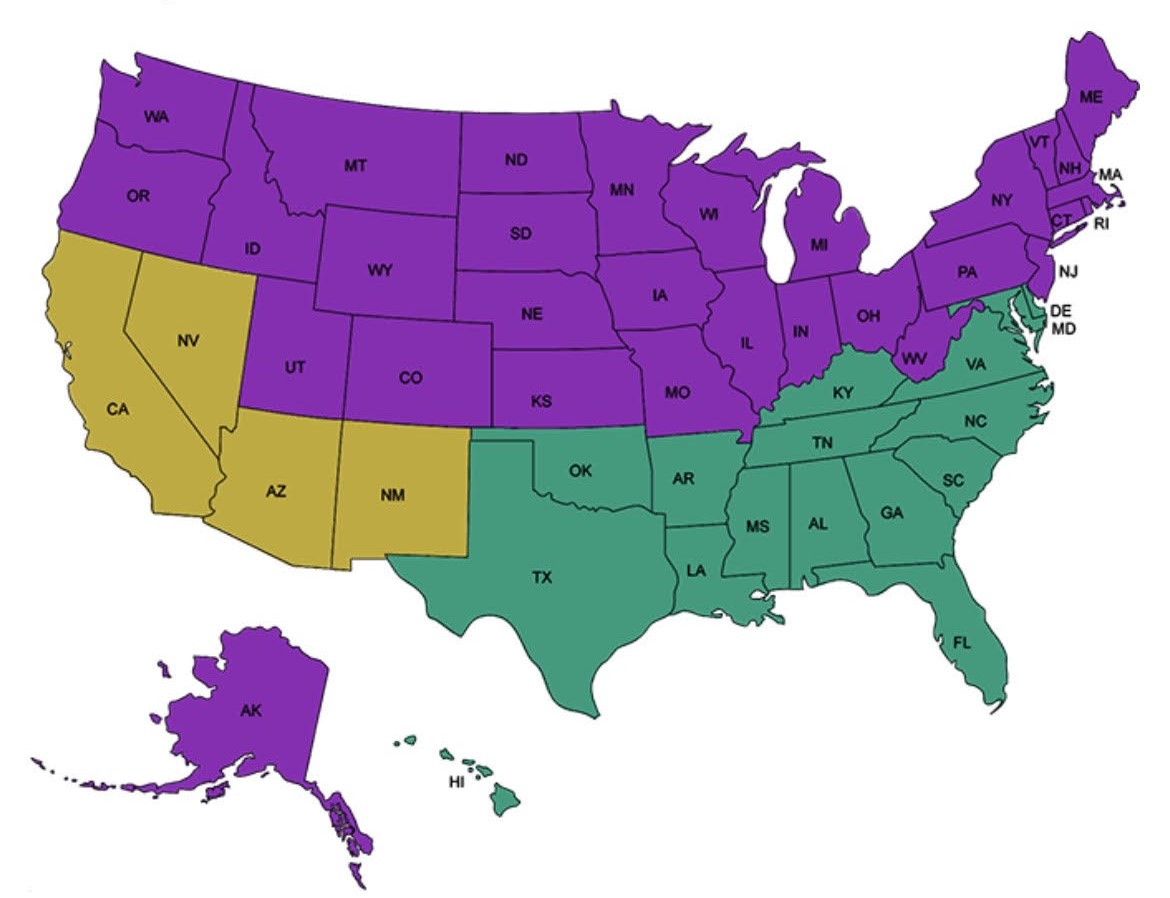

Regional requirements

Depending on your region, rules apply to your rebates based on the date of the installation and when the product you are purchasing was manufactured. To reference, here is a chart of the divided regions

Purple: North

Green: Southeast

Yellow: Southwest

Northern Region:

Dealers can still install equipment after January 1, 2023 that was manufactured prior to January 1, 2023 if it was compliant with the regulations at the time of manufacture.

*On a national level, the same rules apply to heat pumps and packaged units.

Southeast/Southwest regionS:

Split air conditioners installed after January 1, 2023 must meet new minimum efficiency standards, regardless of their date of manufacture. Equipment manufactured prior to January 1, 2023 does not need to pass the new test procedure if the label on the equipment shows a higher SEER rating than the minimum 2023 standard SEER rating. However, these all vary within the state and region.

Start Making Your Home Improvements Today

This IRA act will be in place for 10 years, restating that homeowners can apply for tax credits and rebates every year as long as they are making efficient home improvements on their home. Installing a heat pump will guarantee homeowners rebates and tax credits based on their income compared to their area’s median income.

Due to the increase in demand for these products over the next several years, these prices will increase by about 15 to 20 percent.

Since all new equipment manufactured after January 1, 2023 must meet new minimum efficiency standards and pass new testing procedures, a significant amount of equipment will be considered out-of-date and unable to be used. Fortunately, manufacturers expected this switch and made HVAC equipment that did not meet the new standards unavailable this past fall.

Other efficient home improvements ECI can help you install

Smart thermostats

Smart home devices, like smart thermostats, turn off the heat and AC more often than regular units without sacrificing any comfort. With the ability to use your phone to heat or cool certain zones from anywhere paired with easy installation, you can start to save money immediately. Check out our recent blog post about the top smart thermostats of 2023.

The Inflation Reduction Act of 2022 is designed to accelerate the adoption of all-electric HVAC equipment and lower utility bills for homes and businesses. These tax credits and rebates allow homeowners and business owners across the United States to upgrade their heating and cooling systems and select high-efficiency solutions. Start saving money on your home projects and contact ECI to set up a free consultation to upgrade your system today!

If you live in the Delaware Valley/Greater Philadelphia area and would like to find comfort within your home, visit our website or give us a call at 215 - 245 - 3200 to learn more.