From groceries to gas prices, to bigger purchases like new heating and cooling systems, U.S. homeowners and adults have been feeling the burden of rising prices over the last several months. As a result, the White House signed the Inflation Reduction Act (IRA) into law in August. The $740 billion climate and health care bill aims to reduce emissions, invest in climate protection, and offer eligible homeowners money-saving incentives for "greener" home appliances and systems. Continue reading for an Inflation Reduction Act summary.

What is the Inflation Reduction Act?

A main goal of the IRA is to bring energy bill relief to U.S. households by incentivizing the adoption of more efficient, all-electric appliances. According to Mitsubishi Electric's website, "the IRA recognizes the key role of highly efficient, variable-capacity heat pumps in slashing domestic GHG emissions and lowering energy costs for Americans."

What Does the Inflation Reduction Act Cover?

When it comes to HVAC, the IRA covers heat pumps, heat pump water heaters, and insulation/air sealing. To learn more information on what else the IRA covers, such as rooftop solar panels and electric stoves, click here.

Heat pump

A heat pump can supplement or fully replace your furnace/boiler and AC system by providing both heating and cooling for your home. This highly efficient alternative can save you hundreds of dollars a year on energy bills; and with the Inflation Reduction Act, tax credits and rebates can cover up to 100 percent of the costs for a new heat pump, depending on household eligibility.

No ductwork? No problem! Heat pumps can be ductless, making the installation easier than ever. Ductless heat pumps can heat and cool certain rooms or your whole home and can fit in virtually any space.

Replacement of furnace/AC now

If you're switching to a heat pump before the end of 2022, you could still receive a $300 tax credit. The total of current and previous years' credits -- including those for energy efficiency improvements, high-efficiency furnaces, and air conditioners -- cannot exceed $500.

Replacement of furnace/AC next year

Starting in 2023, households can claim a tax credit for 30 percent of the costs of buying and installing a heat pump up to $2,000, including support for any electric system upgrades needed to make the home heat pump-ready.

As part of the IRA, state programs will offer low- and moderate-income households rebates for heat pumps at the point of sale, cutting costs of purchase and installation up to $8,000. If home electrical upgrades are needed to integrate new heat pumps, rebates of up to $4,000 will also be available to households.

Heat pump water heater

The IRA also assists with installation of heat pump water heaters, which can be two to three times more energy efficient than conventional water heaters. Tax credits and rebates can cover up to 100 percent of the costs depending on household eligibility.

Insulation and air sealing

The Inflation Reduction Act supports different types of home improvements that reduce energy leakage. Not only will this keep your home warmer in the winter, cooler in the summer, and save you money on energy bills, but the additional tax credits and rebates will help you save even more. Insulation material can lower heating and cooling costs by up to 20 percent, and air sealing (like caulking and weather-stripping) saves energy and improves air quality by keeping moisture out. Moreover, the Inflation Reduction Act can cover the costs of home energy audits so that an inspector can identify the best improvement options.

How Will the Inflation Reduction Act Save Me Money on HVAC Costs?

High-Efficiency Electric Home Rebate Program (HEEHRP)

When the government provides a consumer rebate, it uses public funding to help pay for certain goods and services that promote the public benefit. A rebate is sum of money that is credited or returned to a customer on completion of a transaction. In this case, the HEEHRA offers point-of-sale rebates, meaning the rebate amount is automatically deducted from the price at the time of sale – no need to send in for a refund.

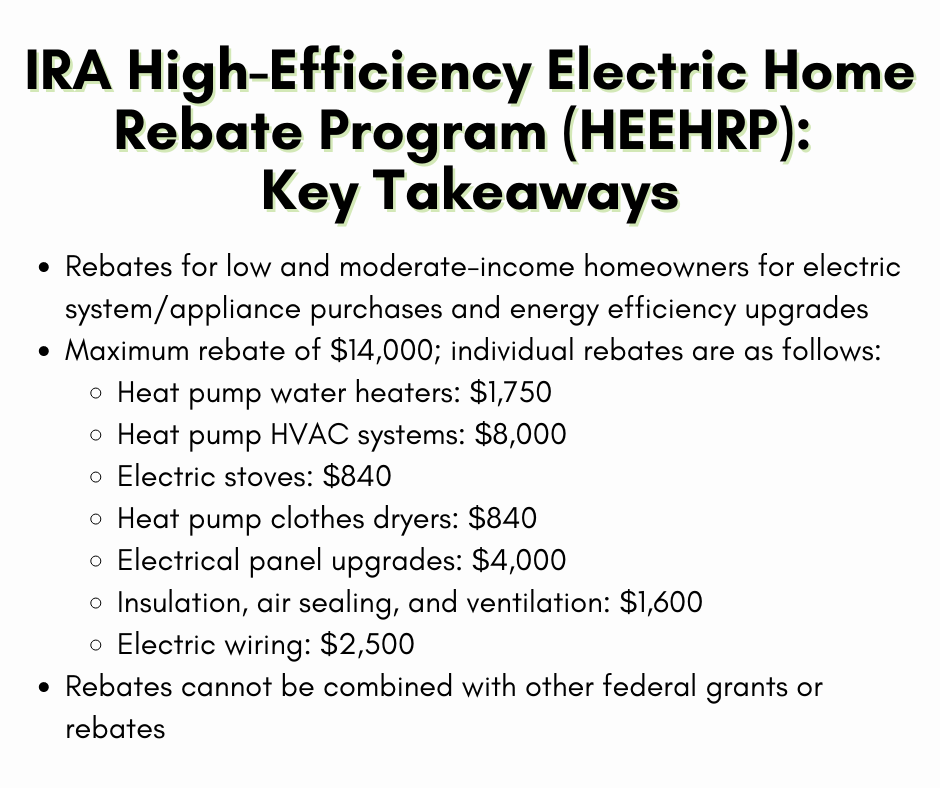

The Inflation Reduction Act implements the High-Efficiency Electric Home Rebate Program (HEEHRP) which provides rebates up to $14,000 per household. This includes up to $8,000 for installing Energy Star-qualified heat pumps, up to $4,000 for electrical panel upgrades, up to $1,600 for home insulation and sealing, and up to $2,500 for home electrical wiring improvements. Eligibility and rebate amounts depend on household income and type of heat pump. The duration of the program will also depend on the amount of funds available within each state and the number of rebates distributed.

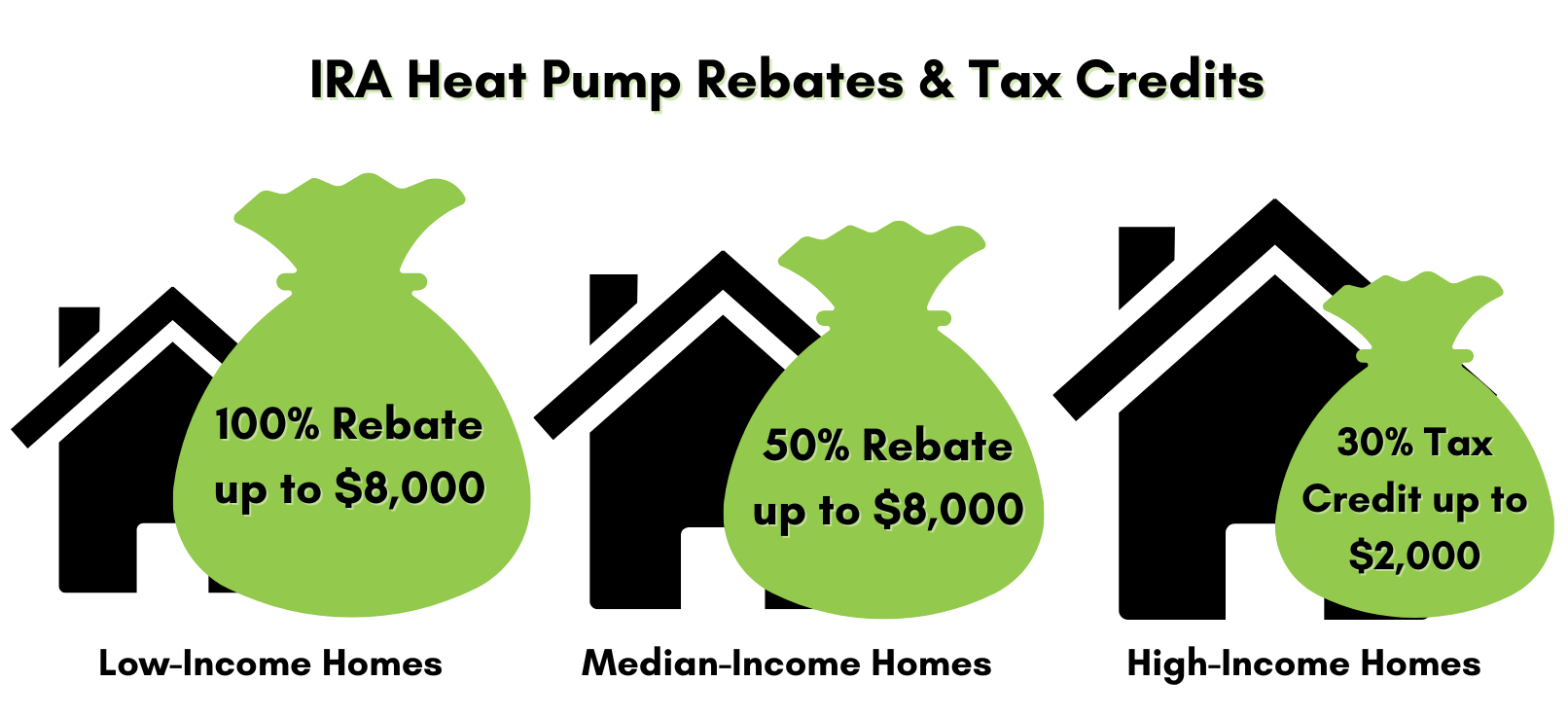

If your household income is 80 percent below your area’s median income, you receive the maximum rebate, covering your new heat pump at 100 percent up to $8,000. If your household income is 81-150 percent of your area’s median income, you’ll receive up to 50 percent of the heat pump’s cost. Even if your household income exceeds 150 percent of your area’s median income, you can receive a 30 percent tax credit of up to $2,000 on new heat pumps. Continue reading below to learn more about the tax credit program.

Energy-Efficient Home Improvement Tax Credit (25C)

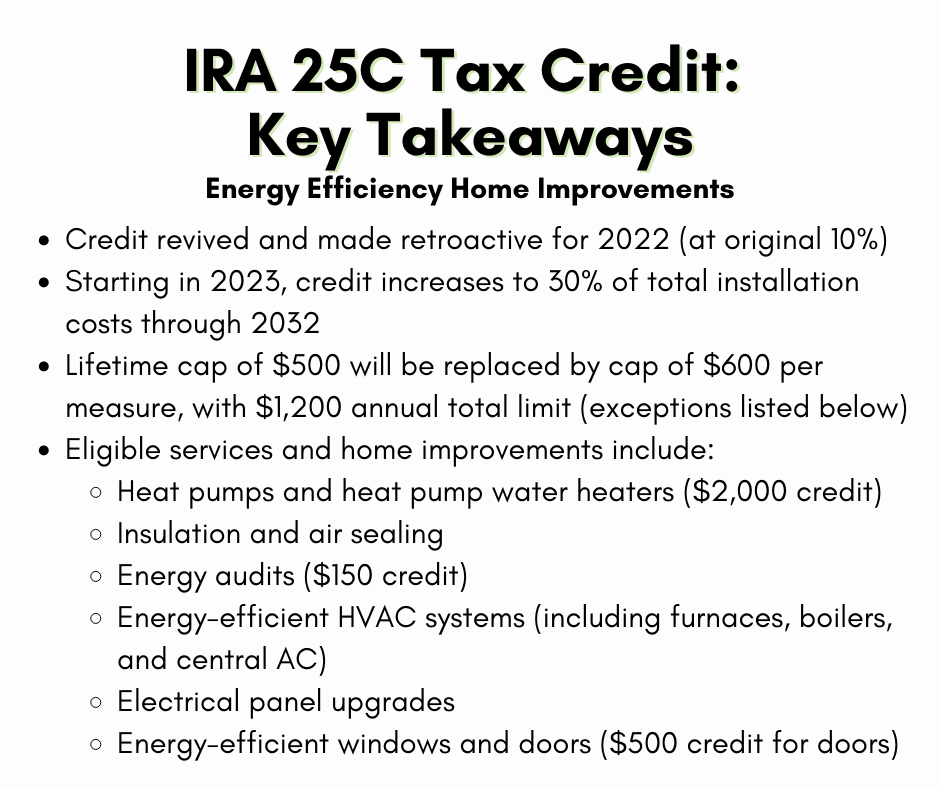

Tax credits can help reduce the amount of tax you owe or increase your tax refund. The renewed Energy Efficient Home Improvement Tax Credit (25C) increases the tax credit limit for installing CEE Advanced-Tier high-efficiency equipment such as heat pumps, central air conditioning systems, furnaces, hot water boilers, and more. The bill extends the offering until December 31st, 2025.

The 25C credit has an annual cap of $1,200, including up to $600 for a qualified air conditioner or gas furnace or up to $2,000 with a qualified heat pump, heat pump water heater, or boiler. There are no income requirements for this tax credit, and it cannot be combined with other federal programs such as the HEEHRP. However, the 25C tax credit may be eligible to combine with local or utility rebates. According to PR Newswire, homeowners who had eligible equipment installed on or after January 1, 2022, may be eligible for retroactive heat pump tax credits under the existing tax credit for up to $300.

Want to learn more about the Inflation Reduction Act? Visit the White House website. If you'd like to learn more about a new system for your Delaware Valley home and qualifying rebates/tax credits, contact ECI Comfort today!